How much should you be saving?

You probably have heard of the rocks and sand analogy when it comes to time management. If you haven’t heard, imagine for a second you have a bucket. In that bucket you fill it up halfway with sand. You have 4 rocks you want to put into the bucket but only 2 of them fit. You really want to get these rocks in the bucket so you decide to reverse the order. You put the rocks in the bucket first and all 4 rocks fit. You then dump in the sand and all the sand fits as well. What you prioritized first not only gets accomplished but you are also able to fit in the accessories as well. This analogy can apply to time, money or business. The “rocks” are the most important things that should be addressed first and the sand is everything else.

When it comes to your money the “rocks'' are your consistent savings and the things you value spending your money on the most. The “sand” is the things you spend your money on that have no tangible increase to your lifestyle. Currently we are in a landscape where interest rates and inflation have been two buzz topics as we have transitioned out of the pandemic. The massive government stimulus and continued low interest rates caused spikes in the housing and stock market. These changing conditions have put great stress on our cash flow and made buying decisions more difficult. How you spend your money will probably have the biggest impact on whether you accomplish your long term financial objectives. So how should you spend your money?

I can’t answer that specifically for you but I do know that your money only goes to 4 places. It is spent, saved, goes to paying debt or to taxes. The amount you decide to allocate is up to you but there are some rules of thumb. Ideally our annual spending wouldn’t exceed 50% of our income, our debt payments wouldn’t exceed 30% and we would want to save at least 15%. Debt in this context is based on minimum payments. These are all general targets but a desirable outcome when comparing your savings vs your total spending(debt+consumption) is going to result in a percentage that is between 20%-24%. In laymen's terms if your current annual savings is let’s say 10%. Taxes are a constant(for the most part) so if you make $100K single or $200K married the government is taking roughly 20%. That leaves 70% that is going toward your lifestyle spending and debt. If we look at your savings of 10% divide that by 70% that gives you 14.3%. This is a solid number but in an ideal scenario, if your taxes were still at 20%, then your savings would be closer to at least 13.5% and your spending at 64.5%. This would give you a saving vs total spending of 20.9%.

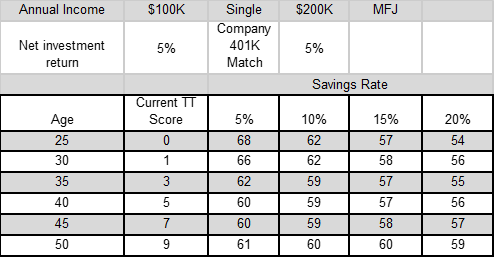

Now before you go to sleep take a look at this chart that compares your savings level and how it impacts your ability to be financially independent without having to take a cut into your lifestyle expenses during retirement.

For reference your TT score is explained more here but in short it compares your annual spending to your net worth. So if you spend $100K annually and you are worth $500K you have a TT score of 5. In other words you could live off of your net worth at your current spending for 5 years without having to make any additional money. Generally you want a minimum TT score of 25 before you feel comfortable to say you are financially independent.

The two variables that you have the most control over are when you start saving and how much you save. The sooner you start saving and the more consistent you are doing it will give you more flexibility to spend more in the future. For example these numbers are based on a fixed level of saving. See the example below for more detail.

Age 25 - $100K salary; 15% savings or $15K

Assuming 3% raises every year

Age 50 salary - $242K; $15K savings or 6.2% of current salary

In summary, look at comparing your savings to your total spending. Shoot to save at least 20% of what you spend(unless you’re temporarily making extra payments towards high interest debt) so that you can save less over time(as a percentage) and spend more.